Imagine walking into a room and being greeted by a warm, inviting smile. That’s what Amazon’s been doing for years, but it’s not just its customer service that’s making waves. The tech giant’s been quietly investing in artificial intelligence, and its latest move could be a game-changer.

With legendary CEO Warren Buffett’s time complete with **Berkshire Hathaway**, many investors are wondering where the company will go under the direction of new CEO Greg Abel. Buffett and Berkshire have been staunch value investors for multiple decades, but could this transition indicate a shift in investment philosophy?

## A New Era for Berkshire

I wouldn’t be surprised if Berkshire becomes more aggressive with Abel at the helm, and maybe invests in an artificial intelligence (AI) stock or two. But which one will it buy?

Berkshire already owns a few stocks that I’d consider AI plays, including **Amazon** (AMZN) and **Alphabet** (GOOG). Berkshire added Alphabet to its portfolio during Q3 2025, and this recent addition has already made it a ton of money.

## Amazon: The Perfect Candidate

The next AI stock Berkshire may purchase could be one it already owns, and I wouldn’t be surprised if Amazon is one of the next stocks it adds to. Berkshire first took a stake in Amazon in 2019 and has added to that position over time, but hasn’t purchased any Amazon shares in a while. Berkshire owns an even 10 million shares of Amazon, which sounds like a ton. However, Amazon is only a 0.8% stake in Berkshire’s investment portfolio. With Amazon being an undersize portion of Berkshire’s portfolio compared to the outsize returns it could generate, it makes sense that the conglomerate may elect to add shares in 2026.

After a so-so start to 2025, Amazon is really starting to gain momentum in the second half of 2025. Net sales rose 13% year over year to $180 billion, with recent high growth rates in several of its key business units. Amazon Web Services (AWS, its cloud computing segment) and advertising services each posted the best growth in multiple quarters. This is key, as both of these business units have much greater operating margins than other commerce-focused business units.

Advertisement

In Q3, AWS made up 66% of Amazon’s total operating profit despite only generating 18% of total sales. With AWS’ growth reaccelerating and it projected to continue that strength into 2026, that bodes well for Amazon’s profit picture.

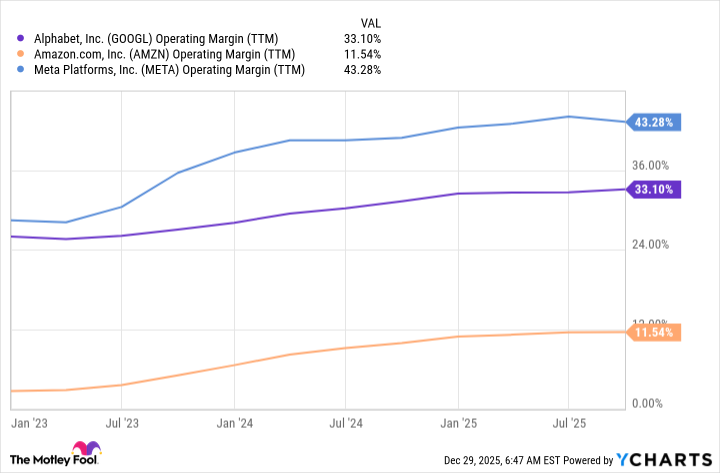

Amazon doesn’t break out the advertising service’s operating margin as it does with AWS. Still, if you look at other advertising-focused businesses like Alphabet and **Meta Platforms** (META), it’s clear that this business unit likely has operating margins in the 30% to 40% range, which is far higher than the whole company’s operating margin.

[](https://ycharts.com/companies/GOOGL/chart/)

[GOOGL Operating Margin (TTM) Chart](https://ycharts.com/companies/GOOGL/chart/)

Also, suggest ONE compelling featured image for this article. Describe it in vivid detail so it can be used to generate or find the perfect visual.